- Jh123x: Blog, Code, Fun and everything in between./

- My Blog Posts and Stories/

- Housing for Profit in SG: Not as it seems/

Housing for Profit in SG: Not as it seems

Table of Contents

Introduction #

In this blog post, we will be going through the prospects of renting out a property in Singapore for profit.

To make this post more realistic, let us set up a profile of a property investor in Singapore.

This is John, a 40-year-old Singaporean who has been working for 15 years. He has saved up enough money and is looking to invest in a property in Singapore to rent out for profit.

His profile is as follows:

- Age: 40

- Current income: $100,000 per year with no bonuses

- Goal of investment: To generate passive income

- Lives with his family in a HDB flat

- Single with no dependents

Depending on you profile, some of the factors below may change. However, the general principles of investing in property remain the same.

Let us calculate the amount of money John gets currently.

Before renting the property #

Income: $100,000

Tax: $3,350 + $20,000 * 11.5% = $5,650

CPF: $16,320

Employer CPF: $13,872

Overall Income + CPF = $108,222

A visualization can be seen below.

Considerations #

Before John even starts investing into property, he has to consider the following:

- What kind of housing is within his budget?

- What are the kind of returns he is looking for?

- What is thr purpose of the investment?

As someone who wants to maximize profits in his housing, these are some factors that John has to consider:

- Rental Yield: This is the annual rental income divided by the property value.

- Cost of borrowing: This is the interest rate that John has to pay for the loan he takes to buy the property.

- Property tax: This is the tax that John has to pay for owning the property.

- Maintenance costs: This is the cost of maintaining the property.

- Agent fees: This is the fee that John has to pay to the agent for finding tenants for his property.

- Capital appreciation: This is the increase in the value of the property over time.

- Income tax: This is the tax that John has to pay on the rental income.

The above are some of the factors that John has to consider before investing in a property. The total amount of money that John makes from his property is the rental income minus the costs associated to owning the property.

Even after the costs are deducted, John has to pay income tax on the rental income in Singapore.

We will be using a more accurate example later in the post in the examples section.

Example #

Let us go through a real life example to illustrate the above points. To make the example more realistic, let us use the profile of John to see what are the available options.

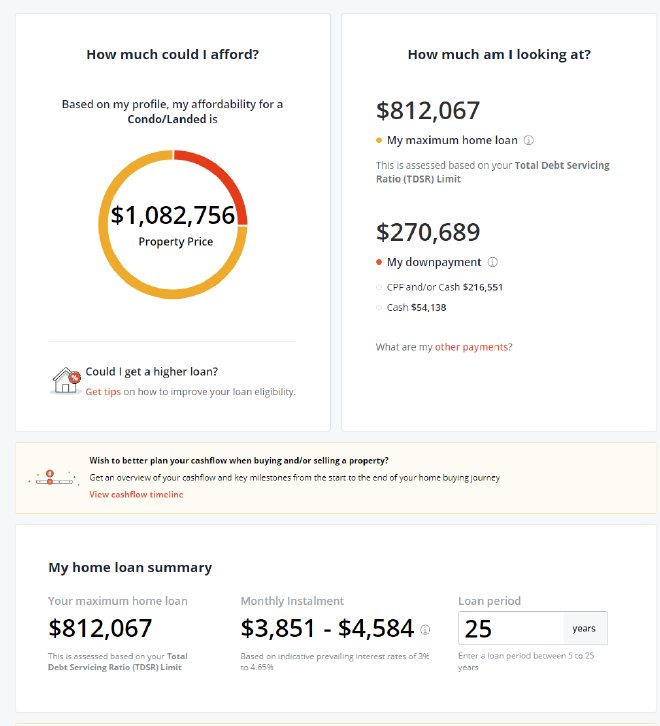

With an income of $100,000 per year, John can afford a loan of up to $812,067 and can buy a property worth $1,082,756.

Assuming John has saved up enough money for $270,689 in down payment. We will treat this as the investment amount for this calculation.

John can look for houses which are around $1,000,000 in value.

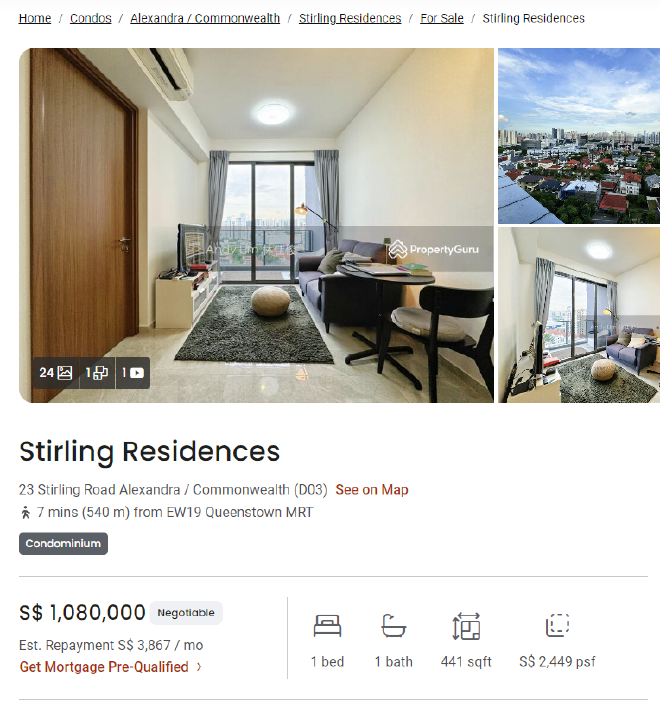

Let’s say that John found this property in Queensway, which is worth $1,000,000.

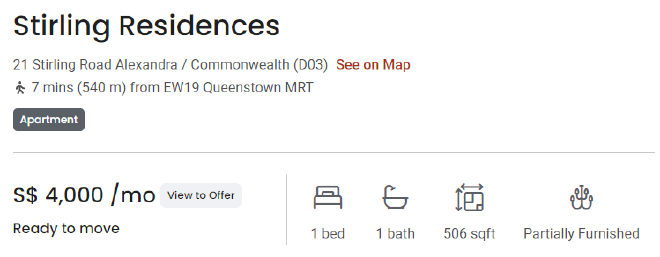

For the same property, we can see that it is also renting at around $4,000 per month

Let’s calculate the rental yield for this property.

Rental Income #

- Monthly rental income:

$4,000(from the above image) - Annual rental income:

$4,000 * 12 = $48,000(This is also the rental value of the property)

CPF Payments #

Income: $100,000

CPF Ceiling: $6,800

# 21% of income goes into OA age 35-45

Total CPF Contribution as of 2024 in OA: 21%

Total CPF Contribution Monthly: $1,428/mth

Total CPF Contribution Annually: $17,136/yr

The money from CPF can be used to contribute to the monthly Mortgage

Mortgage #

Mortgage: $3,851/mth (from the loan calculator at 3% interest)

Annual Mortgage: $3,851 * 12 = $46,212

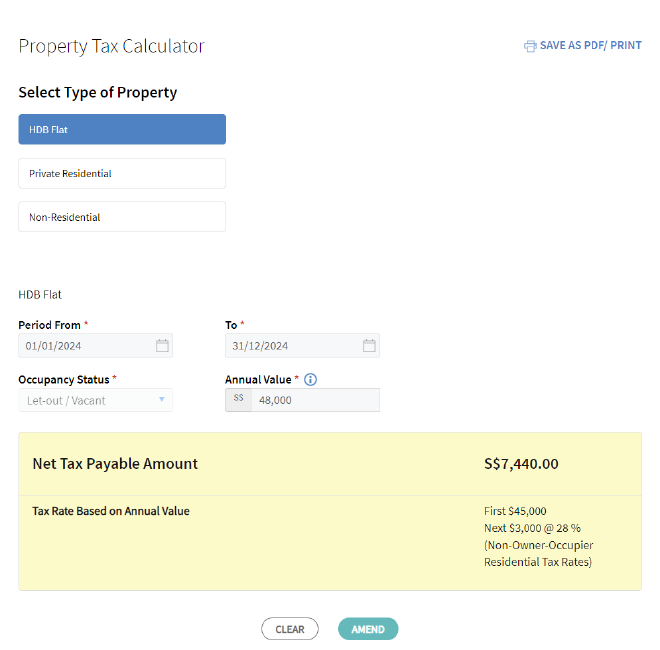

Property Tax #

Based on the property tax calculator, the property tax for this property is $7,440 per year. This is based on IRAS Property Tax Calculator.

Maintenance Costs #

Lets say that the maintenance costs for this property is $500 per month for the admin fees / occasional fixes.

Annual Maintenance Costs: $500 * 12 = $6,000

Agent Fees #

Usually, agent fees are around 1 month’s rent = $4,000

Profits #

Doing some calculations, we can see that the profits from this property is:

Mortgage after CPF = $46,212 - $17,136 = $29,076

Profits = $48,000 - $29,076 - $7,440 - $6,000 - $4,000 = $1,484

Based on our calculations, we can see that John is making a profit of $1,484 per year from this property.

Income Tax #

However, John does not get to keep all of this money. He has to pay income tax on the rental income.

Based on the IRAS website, the tax rate for his bracket ($80,000 - $120,000) is 11.5%.

However, the calculation here is a little bit more complicated. John can use part of his rental expense to offset the taxable income he has to pay.

Property Tax = $7,440

Maintenance Costs = $6,000

Agent Fees = $4,000

Interest on Mortgage = $1,144.02 (At 3% interest)

Overall Tax Deductions = $18,584.02

New Tax Amount = ($20,000 - $18,584.02) + $3,350 = $4,765.98

Putting it together #

The overall calculations can be visualized below.

Based on the above calculations, we can see that John is making a profit:

Total Income + CPF + Principle = $80,227.36 + $13,056 + $32,482.68 = $125,766.04

Total Profits = $125,766.04 - $108,222 = $17,544.04

Investment amount = $270,689

ROI = 6.48%

This works out to around 6.48% per year.

This is different from the $48,000 (4.44%) per year that John is expected to make from the property.

For $270,689 in cash, you receive in these yearly amounts:

Cash = $80,227.36 - $78,030 = $2,197.36

Housing Principle = $32,482.68

Other considerations #

There are some assumptions that we have made in the above calculations.

- John is willing to file the taxes correctly for the rental expenses every year himself.

- The property value does not change over time.

- The rental value does not change over time.

- CPF accrued interest is not considered in the calculations (

2.5%per year in OA)

If you want to take out the Principle from the housing by selling the house, you will have to pay off the CPF amount that you used (at 2.5% interest per year) + the remaining mortgage amount first before you can get the remaining amount in cash.

Conclusion #

In conclusion, there are many factors that you have to consider before investing in a property in Singapore and it is not as straightforward as it seems.

We also have to take into account the opportunity cost for the same amount of money invested in other assets like stocks, bonds, or even other property types.