- Jh123x: Blog, Code, Fun and everything in between./

- My Blog Posts and Stories/

- A look at high yield saving accounts in Singapore/

A look at high yield saving accounts in Singapore

Table of Contents

Introduction #

1 year ago, I was looking at different locations to store my emergency funds. This is where high-yield savings accounts (HYSA) come in. After looking through the different HYSAs myself, I have written this blog post to share more about it.

In this post, I will be going through each of the HYSAs briefly before doing a comparison at the end in a table.

Before we start, let us discuss what are HYSAs.

What are High Yield Saving Accounts (HYSA) #

High Yield Saving Accounts (HYSA) is a savings account that pays a higher interest rate than a traditional savings account. They offer significantly better interest rates than traditional savings accounts, allowing your cash to grow faster. Imagine earning free money just by choosing the right place to put your savings. If you’re looking to build a stronger financial future with minimal effort, high-yield savings accounts could be the key to maximizing your returns while keeping your funds safe and accessible.

This is a good way to make your emergency savings work for you and earn some extra income on the side.

UOB One Account #

This is the one that I am currently using foy my HYSA. To view the current webpage on the HYSA, please visit the UOB One website

For UOB One, there are a total of 3 conditions to be fulfilled on a monthly basis

- Spend $500 on an eligible UOB Credit / Debit card

- Credit a minimum salary of $1,600

- Make 3 GIRO Debit Transactions per month

As of the time of writing, PayNow with the relevant remarks can also be counted as Salary Credit.

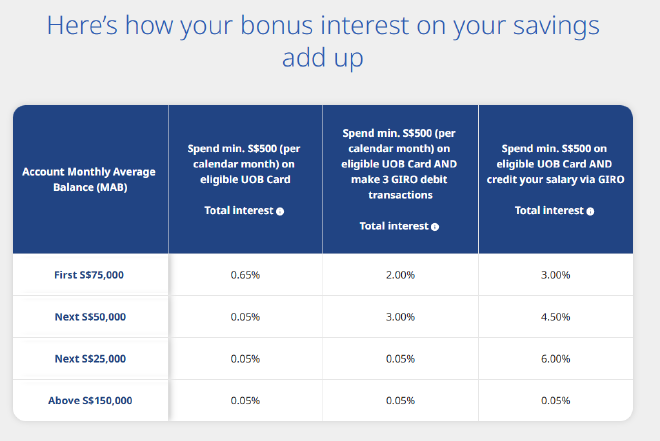

Based on the conditions that you fulfill above, the interest rates can be seen on the table below.

OCBC 360 #

This is the one that I will recommend for those who are currently looking for a HYSA. To view the current webpage on the HYSA, please visit OCBC 360 website

OCBC 360 has more conditions compared to UOB, however, there are not specified ordering. For each of the criteria that you hit, you can get an added interest rate.

The criteria are on a monthly basis

- Credit Salary of at least $1,800

- Increase average daily by $500

- Spend at least $500 to selected OCBC Credit Cards

- Purchase an eligible insurance product from OCBC

- Purchase an eligible investment product from OCBC

- Maintain an average daily balance of at least $200,000

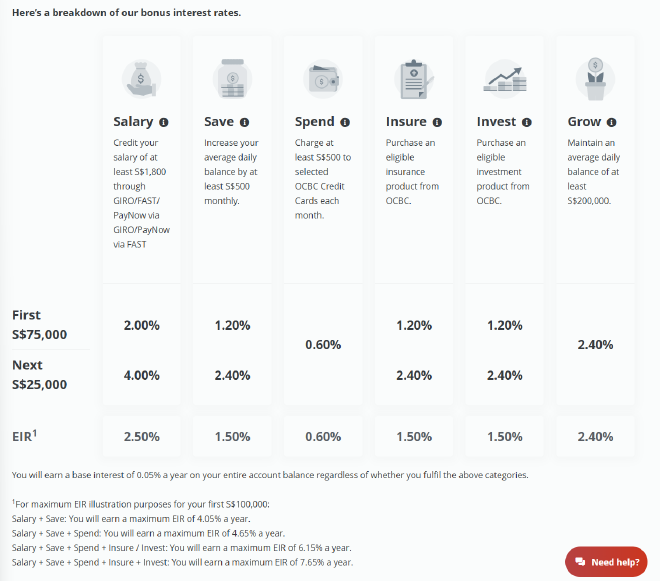

The breakdown of the interest rates are as shown below

DBS Multiplier #

I will not recommend this as the criteria to get better interest rates are not very realistic and most of us do not fall under this category. To visit their website, please go to the DBS Multiplier Website

The DBS Multiplier account has the following breakdown.

- Credit Income

- Spend on any of the following categories

- Credit Card / PayLah / Retail Spend

- Home loan installment

- Insurance

- Investments

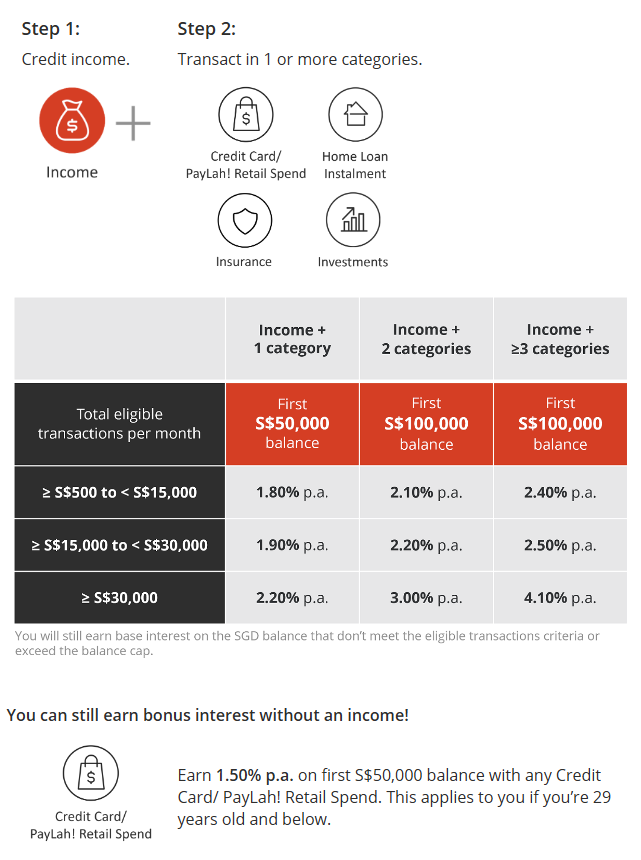

The number of categories above will determine the interest rates you will receive

The breakdown of the interest rates are as shown below

Trust Bank #

Trust bank is good to have if you spend a lot on NTUC to get additional cashback. To visit their website, please go to the Trust Bank Website In this article, we will only be talking about the interest rates that are offered by Trust Bank.

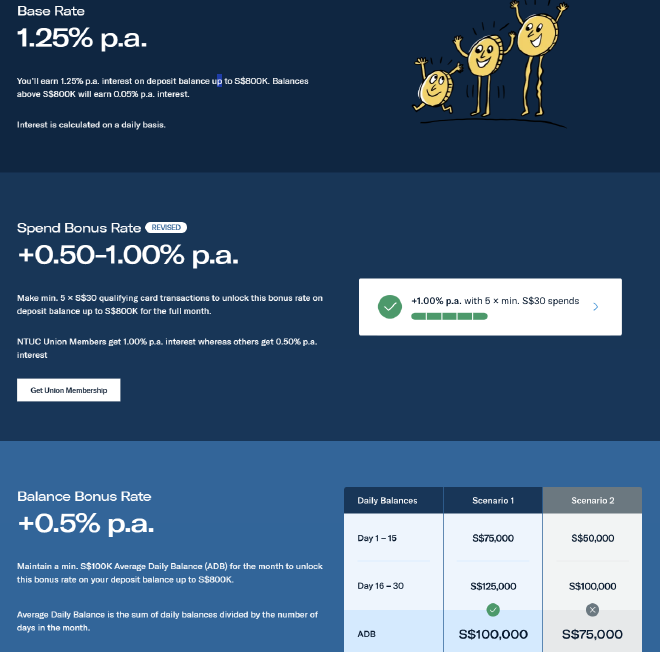

This are the conditions to get the bonus interest rates in Trust Bank

- 1.25% Base rate

- 0.5%-1% based on the number of qualifying Transactions

- 0.5% bonus rate if you have a minimum of 100k average daily balance

- 0.75% for salary deposit

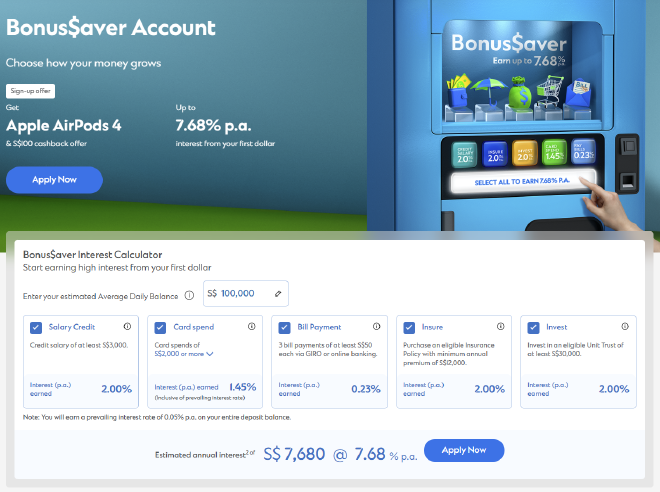

Standard Chartered Bonus $aver account #

For their official website, please visit Standard Chartered Website

The conditions to maximize the interest rates are as follows

- Credit Salary (2%)

- Card spend of > $2000 (2%)

- 3 Bill payments of at least $50 (2%)

- Purchase an eligible insurance with yearly premium of $12,000

- Invest in an eligible unit trust of at least $30,000

Currently there is a sign up gift of Air Pods 4 and a $100 cashback offer.

Chocolate Finance #

This is recommended for those who are not drawing a salary. However, the interest rates were revised recently (start of Nov 2024) so I am not sure how long the interest rates will continue to last.

- For the 1st 20k, the interest rate is 3.6%

- For the next 30k, the interest rate is 3.2%

For any amount above that, it is invested into bonds (at a target rate of 3.2%). The investment interest rate may fluctuate around the 3.2% mark and may do better or worst based on economic conditions. As a result, I will not be taking the target interest rates into account for this article.

Referral: https://share.chocolate.app/nxW9/l0tqqxem

Maribank #

This is the most hassle free savings account. This is recommended to anyone who shops on Shopee a lot as there are exclusive vouchers and discounts when paying through Maribank. For their official website, please visit Maribank Official Website

There are no conditions for Maribank, just a 2.7% flat interest rate and a maximum balance of 100k.

For those who have > 50k and do not want to take the risk of investing in bonds under Chocolate Finance, this is a safer solution (For amounts above 50k).

However, there is a limitation where you cannot put more than 100k into the bank account.

For those who are interested to sign up with a referral code, this is my referral code: 4QTP99MT.

Some other considerations #

Here are some other avenues for consideration. However, these mainly use the money for investment instead of giving out a stable interest rate. As a result, I will not be going through them within this article.

- Wise: 3.28% on SGD after annual fees of 0.68%

- IBKR: After the 1st 10k USD, the interest rates increase up to ~4%.

Conclusion #

Different savings account satisfies different needs of different individuals. To find out more about which savings account will earn you the most interest, you can visit the website below:

Some generate recommendations will be to stick with Chocolate Finance when just starting out and eventually convert it to an OCBC 360 after you have amassed 50k.

Summary #

This is the summary of the different policies. For each of the HYSA, there will be to corresponding columns below

- Name of account: The name of the HYSA

- Min i/r: Minimum interest rate for the bank for the deposit amount

- Max i/r: Maximum interest rate for the bank for the deposit amount

- Deposit: Deposit cap to make full use of the interest

| Name of account | Max i/r | Min i/r | Deposit required | Referrals | Remarks |

|---|---|---|---|---|---|

| UOB One | 4% | 0.05% | $150,000 | N/A | |

| OCBC 360 website | 10.05% | 0.05% | $100,000 | N/A | |

| DBS Multiplier Website | 4.1% | 0.05% | $100,000 | N/A | |

| Trust Bank Savings Account | 3.5% | 1.25% | $800,000 | N/A | |

| Standard Chartered | 7.68% | 0.05% | $100,000 | N/A | |

| Chocolate Finance | 3.2% | 3.36% | $50,000 | Referral URL | Any amount on top of the 50k is invested instead |

| Maribank | 2.5% | 2.7% | N/A | Referral Code: 4QTP99MT | Works with any amt up to 100k |