- Jh123x: Blog, Code, Fun and everything in between./

- My Blog Posts and Stories/

- SG Taxes: A Guide to personal taxes in Singapore/

SG Taxes: A Guide to personal taxes in Singapore

Table of Contents

Introduction #

Singapore has a progressive personal income tax system. This means the more you earn, the higher the tax rate you pay.

I will mainly be going through the new tax rates that is implemented this year. The changes from the previous years mainly affects the higher income earners.

The bracket that earns from $500k to $1m has been increased from 22% to 23% and the bracket that earns more than $1m has been increased from 22% to 24%.

Tax Residency #

You will have to pay the resident tax rate if you fulfill any of the following conditions:

- You are a Singapore Citizen or Singapore Permanent Resident (PR) who resides in Singapore except for temporary absences

- Foreigner who has stayed/worked in Singapore for at least 183 days in the previous year

- Foreigner who has stayed/worked in Singapore for 3 continuous years (even if the 1st and 3rd year is less than 183 days)

- Foreigner who has worked in Singapore for a continuous period between 2 calendar years and the stay > 183 days including physical presence before and after your employment. (Excluding directors, public entertainers and professionals)

Tax Brackets #

To get the full tax rates, you can refer to the IRAS website.

Resident Tax Rates from YA 2024 onwards #

| Chargeable Income | Tax Rate | Max Tax Amount for the amount | Total Income So Far |

|---|---|---|---|

| First $20,000 | 0% | 200 | 0 - 20,000 |

| Next $10,000 | 2% | 250 | 20,000 - 30,000 |

| Next $10,000 | 3.5% | 350 | 30,000 - 40,000 |

| Next $40,000 | 7% | 2800 | 40,000 - 80,000 |

| Next $40,000 | 11.5% | 4600 | 80,000 - 120,000 |

| Next $40,000 | 15% | 6000 | 120,000 - 160,000 |

| Next $40,000 | 18% | 7200 | 160,000 - 200,000 |

| Next $40,000 | 19% | 7600 | 200,000 - 240,000 |

| Next $40,000 | 19.5% | 7800 | 240,000 - 280,000 |

| Next $40,000 | 20% | 8000 | 280,000 - 320,000 |

| Next $180,000 | 22% | 39600 | 320,000 - 500,000 |

| Next $500,000 | 23% | 115000 | 500,000 - 1,000,000 |

| Above $1,000,000 | 24% | - | - |

The tax rates are progressive, with the tax rate increasing as the chargeable income increases. To calculate the tax amount, you will have to calculate the tax amount for each bracket and add them up.

The general formula to calculate the tax amount is:

Total Tax = (Max Tax Amount for the previous bracket) + [(Income - Lower Limit of the bracket)] * (Tax Rate for the bracket)

Let us go through an example to illustrate how to calculate the tax amount.

Income: $65,000 / Yr (Including Bonus)

Bracket: $40,000 - $80,000 (4th Row)

Total Tax = $350 + [$65,000 - $40,000] * 7 %

= $350 + $25,000 * 7%

= $350 + $1,750

= $2,100

Non-Resident Tax Rates #

For non-resident tax on employment income, the tax rates are flat at 15% or the resident tax rates, whichever is higher.

For director fees, consultation fees and other income, the tax rate is a flat 24% and applies to all incomes including the following.

- Rental Income

- Pensions

- Director’s Fees

Except employment income and certain income taxable at reduced withholding tax rates.

Withholding Tax Rates #

The withholding tax rates are based on the type of income.

| Type of Income | Withholding Tax Rate |

|---|---|

| Remuneration including director’s fees received by non-resident directors | 24% |

| Non-resident professional for services performed in Singapore | 15% of gross income OR 24% of net income |

| Non-resident Public Entertainers for Services performed in Singapore | 15% concessionary rate |

| SRS Withdrawals by non-Singapore SRS Account Holders | 24% |

| Interest, commission fee or other payments with loan/debts | 15% reduced final withholding tax rate OR 24% if reduced tax is not applicable |

| Royalty of other lump sum payments | 10% reduced final withholding tax rate OR 24% if reduced tax is not applicable |

Tax Reliefs/Deductions #

Here are all of the reliefs that you can claim.

| No | Relief | Claim Method |

|---|---|---|

| 1 | Earned Income Relief | Auto-included in your tax assessment unless handicapped |

| 2 | Spouse/Handicapped Spouse Relief | File for the 1st time, otherwise auto-included |

| 3 | Foreign Domestic Worker Levy Relief | File for the 1st time, otherwise auto-included |

| 4 | CPF Relief | Included if employer is in Auto-inclusion Scheme else no |

| 5 | NSMan Relief | Auto-included |

| 6 | Parent/Handicapped Parent Relief | File for the 1st time, otherwise auto-included |

| 7 | Grandparent Caregiver Relief | File for the 1st time, otherwise auto-included |

| 8 | Qualifying Child/Handicapped Child Relief | File for the 1st time, otherwise auto-included |

| 9 | Working Mother’s Child Relief | File for the 1st time, otherwise auto-included |

| 10 | Handicapped Brother/Sister Relief | File for the 1st time, otherwise auto-included |

| 11 | Life Insurance Relief | File for the 1st time, otherwise auto-included |

| 12 | Course Fees Relief | Claim every time |

| 13 | SRS contributions and tax relief | Auto-included |

| 14 | Central Provident Fund (CPF) Cash Top-up Relief | Auto-included |

| 15 | MediSave contributions | Auto-included (From qualifying sums) |

| 16 | Donations | |

| 17 | Rental income deductions | Claim every time |

| 18 | Employment Expenses | Claim every time |

The details for each of them can be found in the appendix when you click on each of the link.

Note:: There is a cap on the maximum amount of reliefs that you can claim. The relief only deducts your chargeable income and not the tax amount directly.

If you earn $65,000 a year from full time employment, your chargeable income will be $65,000 before all deductions.

To check for the list of reliefs and deductions that you are eligible for, you can refer to this IRAS Questionnaire

Simply fill up your status and look at the sections which are relevant to you.

Scenarios to consider #

Do’s #

House buyers #

For house buyers, I will recommend taking a look at the CPF Cash Top-up Relief.

By topping up your CPF every year (up to $8000), you can reduce your chargeable income by the amount that you have topped up.

On top of that, that CPF amount can be used to pay for your housing in the future.

Investment for retirement #

For those who are looking to invest for retirement, I will recommend taking a look at the SRS contributions and tax relief.

If you are a Singapore Citizen, you can contribute up to $15,300 a year and reduce your chargeable income by the same amount.

The SRS account can be used to invest in a variety of instruments such as stocks, bonds, unit trusts and ETFs in Singapore. It is equivalent to a 401k in the United States.

Part time students / Course takers #

For part time students or course takers, I will recommend taking a look at the Course Fees Relief.

You can claim up to $5500 a year for the course fees that you have paid.

This relief can be deferred if your income does not exceed $22,000 in the first year or within 2 years from the year you have completed the course, whichever is earlier.F

Don’ts #

Donate money to charity ONLY to get tax relief #

Donating money to charity just to get tax relief is not a good idea. Let us calculate the tax relief for a $1000 donation even for someone at the maximum tax bracket.

Amount spent on donations = $1000

Tax Relief = $1000 * 2.5

= $2500

Tax saved = $2500 * 24%

= $600

For a $1000 donation, you will only save $600 in taxes. Please donate to charity only if you believe in the cause and not just for the tax relief.

However, there is a small chance you can save some taxes based on this.

Based on that you can add some additional information to the formula

Amount spent on donations = $1000

Tax Relief = $1000 * 2.5

= $2500

Tax saved = $2500 * 24%

= $600

$$ Saved = $600 + (Experience/things from fundraising event)

In this case, you can save some taxes if the experience/things from the fundraising event is worth more than $400 to you.

However, there are some companies that allows for 1:1 donation matching. Let us calculate the tax relief for a $1000 donation for someone at the maximum tax bracket at the 1:1 matching rate

Amount spent on donations = $1000

Tax Relief = $1000 * 2 * 2.5

= $5000

Tax saved = $5000 * 24%

= $1200

In this case the tax payer can save $200 by spending $1000 in donations.

The threshold for this is at 20%

Tax saved = $5000 * 20%

= $1000

At 20% the savings is equal to the amount spent, so any tax amount > 20% at a 1:1 donation matching should reduce the total tax amount.

Conclusion #

This is my take on the Singapore Personal Income Tax system. This is not financial advise and you should always do your own homework before making any decisions based on this. There are also other forms of tax reliefs that are not covered in this article. You can find them on the IRAS website or refer to Appendix A for a brief summary of each of them.

Appendix A: Details of Tax Reliefs/Deductions #

Earned Income Relief #

You are eligible for Earned Income Relief if you are a tax resident and have earned income from the following sources in the previous year.

- Employment

- Pension

- Trade/Business/Profession/Vocation

Not handicapped #

| Age on last day of previous year | Max Claimable Amount |

|---|---|

| Below 55 | $1,000 |

| 55 to 59 | $6,000 |

| 60 and above | $8,000 |

Handicapped #

| Age on last day of previous year | Max Claimable Amount |

|---|---|

| Below 55 | $4,000 |

| 55 to 59 | $10,000 |

| 60 and above | $12,000 |

Spouse/Handicapped Spouse Relief #

To qualify for the deduction, you must fulfil the following conditions:

- Your Spouse is living & Supported by you (Unless legally separated under a court order / Deed of separation.)

- Your Spouse has an annual income of less than $4000 in the previous year (In 2025 it will be increased to $8000)

Divorced taxpayers who pay alimony to their ex-spouse cannot claim this relief.

| Relief Type | Max Claimable Amount |

|---|---|

| Spouse Relief | $2,000 |

| Handicapped Spouse Relief | $5,500 |

| Legally separated spouse | Lower of $2,000 for spouse relief or $5,500 for handicapped spouse relief |

For more information on the filing, you can refer to the IRAS Website.

Foreign Domestic Worker Levy (FDWL) Relief #

To qualify for the deduction, you must fulfil the following conditions:

- You are a married woman

- You/Your Spouse employs a foreign domestic worker

- Either of the following

- Married and living together

- Married and Spouse is not a tax resident in singapore

- Divorced / Widowed and living with children (Eligible for child relief)

This relief can only be used to offset your earned income.

| Normal | Concessionary | |

|---|---|---|

| Months of Levy paid in one AY | 12 | 12 |

| Total Levy paid | 3600 (300 * 12) | 720 (60 * 12) |

| Maximum relief | 7200 (2 * 3600) | 1440 (2 * 720) |

If you only pay the levy for 3 months, you will only be eligible for 3/12 of the relief.

In 2025, this relief will be changed to a relief of $60/month according to the Adjustment of Marriage and Parenthood Tax Measures.

CPF Relief #

The CPF relief has 2 different parts

- For Employees

- For Self-Employed

For Employees #

The CPF contributions that are eligible for the relief are as follows:

- Compulsory CPF contributions under the CPF Act to an approved pension or provident fund

- Voluntary Contributions to the MediSave Account

Not eligible for relief:

- Voluntary Contributions in excess of the compulsory contributions

- CPF contributions on > 2 related employers

- CPF Made in respect of overseas employment

The tax relief is calculated using the following formula

CPF Relief = (CPF Contribution for Salary + CPF Contribution for Bonus) * 20%

The maximum CPF relief is capped at $20,400, broken down into $66,900 from Salary and $35,100 from bonuses.

You do not have to file for this if your employer is in the Auto-Inclusion Scheme for Employment Income. To check if your employer is in the scheme, you can refer to the IRAS Website.

To find out more, you can refer to the IRAS Website.

For Self-Employed #

To qualify, you must have contributed to the following accounts:

- Employee CPF Contribution (See above)

- Compulsory & Voluntary MediSave Contributions

The tax relief is calculated using the following formula

37% * (Net trade income * 17)

The net trade income is capped at $6800 for 2024.

For more information, you can visit the IRAS Website.

NSMan Relief #

All NSMen, spouses and parents of NSMen are eligible for NSMan relief.

To be counted as an NSMan, you have to fulfill any of following

- Completed Full time NS under the enlistment act

- Deemed to have completed by the proper authority

- Regulars who have not committed any disciplinary offenses or criminal offenses in the previous year

The relief is as follows:

| Relationship to NSMan | Max Claimable Amount | Criteria |

|---|---|---|

| Self | $1500 | No NS training in the previous year |

| Self | $3000 | Completed NS training in the previous year |

| Self | $3500 | No NS training in the previous year and is a Key Appointment Holder |

| Self | $5000 | Completed NS training in the previous year and is a Key Appointment Holder |

| Wife | $750 | SG Citizen + Husband is NSMan |

| Parent | $750 | SG Citizen + Son is NSMan + Son is born to family / or legally adopted |

Any NSMan who can claim the relief cannot claim the relief again under the wife or parent category.

Parent/Handicapped Parent Relief #

To qualify for the deduction, you must fulfil the following conditions:

- Supported your dependant (listed below) in the previous year

- Parent

- Parent-in-law

- Grandparent

- Grandparent-in-law

- Step-parent

- Step-grandparent

- Adoptive parent

- Adoptive grandparent

- Dependant is > 55 years old

- Dependant’s annual income is less than $4000 in the previous year (In 2025 it will be increased to $8000)

- Dependant is living in the same household OR You have incurred 2000 or more supporting him/her

The relief is as follows:

| Type of Parent Relief | Amount | Handicapped Amount |

|---|---|---|

| Staying together with dependant | $9000/dependant | $14000/dependant |

| Not staying together with dependant | $5500/dependant | $10000/dependant |

You may claim for up to a maximum of 2 dependents.

If you claimed for this, no other claimant can claim the same person for

You can still claim for the deceased person if he/she passed away in the previous year but not anymore from the following year.

For more information, you can visit the IRAS Website.

Grandparent Caregiver Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- You are a working mother who is married, divorced or widowed

- Your parent/grandparent/parent-in-law/grandparent-in-law fulfils the following

Resides and lives in Singapore

Looks after any of

- Children who is a Singapore Citizen under the age of 12

- Unmarried handicapped children who is a Singapore Citizen in the previous year

- Not earning income exceeding $4000 from any trade/business/vocation/employment in the previous year

- No one else has claimed this for the same caregiver for any other deductions

We can claim $3000 on our parent, grandparent, parent-in-law or grandparent-in-law.

To find out more, you can refer to the IRAS Website.

Qualifying Child/Handicapped Child Relief (QCR/HCR) #

To qualify for the deduction, you must fulfil ALL the following conditions:

- Your unmarried child is either

- Born to you and your spouse/ex-spouse

- Is a step child

- Is legally adopted

- Your child is either

- Below 16

- Above 16 and studying full time at any college or other educational institution at any time in the year.

- Your child’s annual income is less than $4000 in the previous year (In 2025 it will be increased to $8000)

The relief is as follows:

| Type of Child Relief | Amount |

|---|---|

| Qualifying Child Relief | $4000 |

| Handicapped Child Relief | $7500 |

You can claim this for both the Working Mother’s Child Relief and this relief if you qualify for both.

To find out more, you can refer to the IRAS Website.

Working Mother’s Child Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- You are a working mother who is married, divorced or widowed

- Have taxable earned income from employment or through pensions/trade/business/profession/vocation

- Maintained a child who is a Singapore Citizen and Satisfy all the conditions for Qualifying Child/Handicapped Child Relief

The relief depends on the order of the child, which is determined by the following table

| Type of Child | Criteria for order |

|---|---|

| Child born to you and your spouse/ex-spouse | Date shown in birth certificate |

| Pre-marriage child | Date of marriage |

| Step-child | Date shown in birth certificate |

| Legally adopted child | Date of adoption |

A deceased / Stillborn child is considered as a child.

The relief is as follows:

| Order of Child | Amount |

|---|---|

| 1st | 15% of mother’s income |

| 2nd | 20% of mother’s income |

| 3rd | 25% of mother’s income |

The QCF/HCF has higher priority than this relief and will be claimed first before this relief.

The cap for this relief is $50,000 per child.

For more information, you can visit the IRAS Website.

Handicapped Brother/Sister Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- Your dependant is physically or mentally handicapped

- Your dependant is either

- Living with you in the same household in Singapore

- Living in a separate household in Singapore and you have incurred $2000 or more supporting him/her

You may claim for $5500 for each handicapped brother/sister/brother-in-law/sister-in-law.

To find out more, you can refer to the IRAS Website.

Life Insurance Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- You paid insurance premiums on your own life insurance policy

- The insurance company must have a office/branch in Singapore and your policy is taken on or after 10/08/1973 (DD/MM/YYYY)

- Your total CPF Contribution was less than $5000 in the previous year including

- Compulsory Employee’s CPF Contribution

- Compulsory MediSave/Voluntary CPF contribution as a self-employed individual

The relief is as follows:

The lower of the following:

- The difference between $5000 and your CPF contribution.

- Up to 7% of the insured amount or the amount of insurance premiums paid.

For more information, you can visit the IRAS Website.

Course Fees Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- Attend any course of study for the purpose of gaining an approved academic, professional or vocational qualification

- The course can be applied in a vocation or specific area of an industry

- The course provider is a registered entity with the Accounting and Corporate Regulatory Authority (ACRA)

To check for the list of approved courses, you can refer to the ACRA Website.

The relief is as follows:

- $5500 each year regardless of the number of courses taken.

The following types of fees can also be claimed:

- Aptitude test fees

- Examination fees

- Registration/Enrolment fees

- Tuition fees

For courses that are co-funded by the employer, you can only claim for the section that you have to pay yourself.

The relief can also be deferred if your income does not exceed $22,000 in the first year OR within 2 year period from the year you have completed the course, whichever is earlier.

To find out more, you can refer to the IRAS Website.

SRS contributions and tax relief #

Unlike the other reliefs in this list, the SRS contributions do not really have any conditions to fulfill. Instead it is proportional to the amount of money you contribute to your SRS account in the previous year.

For every dollar you contribute to your SRS account, you can claim a dollar off your chargeable income.

There is a yearly cap of $15,300 for Singapore Citizens and $35,700 for foreigners and Singapore Permanent Residents.

However, you will not be allowed for SRS Tax relief if you have fulfilled any of the following conditions:

- Your SRS account is suspended before the end of the previous year.

- Amount is withdrawn from SRS in the same year of contribution.

To find out more about the SRS, you can refer to the IRAS Website.

CPF Cash Top-up Relief #

To qualify for the deduction, you must fulfil ALL the following conditions:

- Be a Singapore Citizen / Permanent Resident

- Have made cash top ups in the CPF retirement sum topping up scheme

The relief is as follows:

| Type of Top-up Relief | Max Claimable Amount |

|---|---|

| Less than $8000 | Exact amount of cash top up |

| More than $8000 | $8000 |

You can top up for any of the following people:

- Yourself

- Parents / Parents-in-law

- Grandparents / Grandparents-in-law

- Handicapped Siblings

- Handicapped Spouse

- Spouse earning less than $4000 in the previous year

- Siblings earning less than $4000 in the previous year

To find out more about the CPF Cash Top-up Relief, you can refer to the IRAS Website.

Compulsory and voluntary MediSave contributions #

To qualify for the deduction, you must fulfil ANY of the following conditions:

- You are a Singapore Citizen or Singapore Permanent Resident

- Made voluntary contributions to your MediSave account

- Derive any source of income for the year that you contributed.

The amount of MediSave that you have to contribute + the amount of voluntary contributions that you have made can be claimed as a relief.

There is a cap of $37740 a year for the relief.

To find out more about the MediSave contributions, you can refer to the IRAS Website.

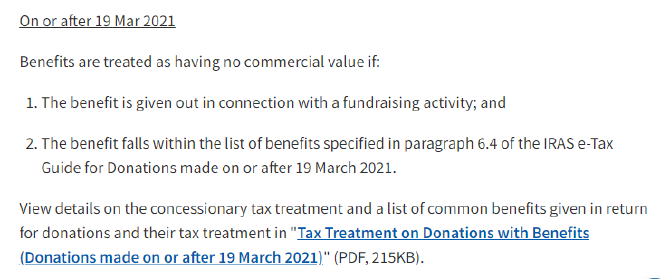

Donations #

Donations which fulfill Any of the following conditions can be claimed as a relief:

- Cash donations for local causes

- Cash donations for overseas causes

- Shares Donation

- Artefact donations

- Donations under the public art tax incentive scheme

- Land & Building donations

- Naming donations

For this article, I will only be covering the cash donations for local causes. This will only apply to donations made to an approved Institution of a Public Character (IPC) or the Singapore Government. To find out what charities are eligible for tax deduction, you can refer to the Charities.Gov.

You can claim the following relief for the donations based on the following formula:

Amount Deductible = (Donated Amount * 2.5)

Note: that there are some companies that do 1:1 donation matching. It will be the formula below.

Amount Deductible = (Donated Amount * 5)

Income from property rented out #

This is more complicated and will not be covered in the scope of this article. To find out more, you can read about it here IRAS Website.

Employment expenses #

Similar to the previous point, this is more complicated and will not be covered in the scope of this article. To find out more, you can read about it here IRAS Website.